Kyvo has launched Long-Term Staking (Lock Up), giving OPT holders a new way to increase time-weighted participation in network distributions by locking already staked OPT for a defined period.

Long-Term Staking is designed for community members who plan to hold OPT long-term and want their participation weighted more heavily based on commitment length, while also supporting long-term network stability.

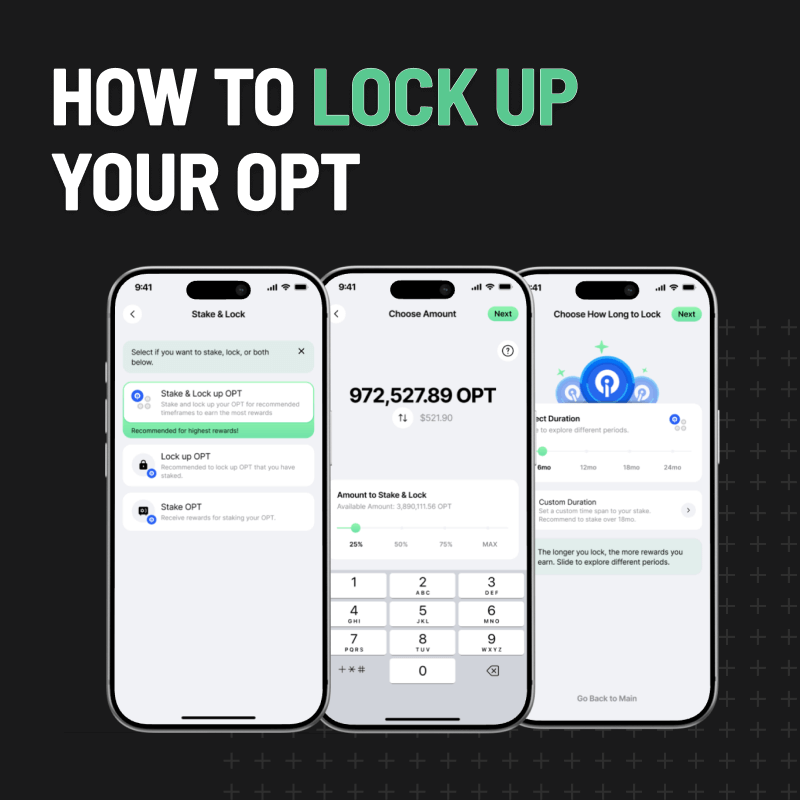

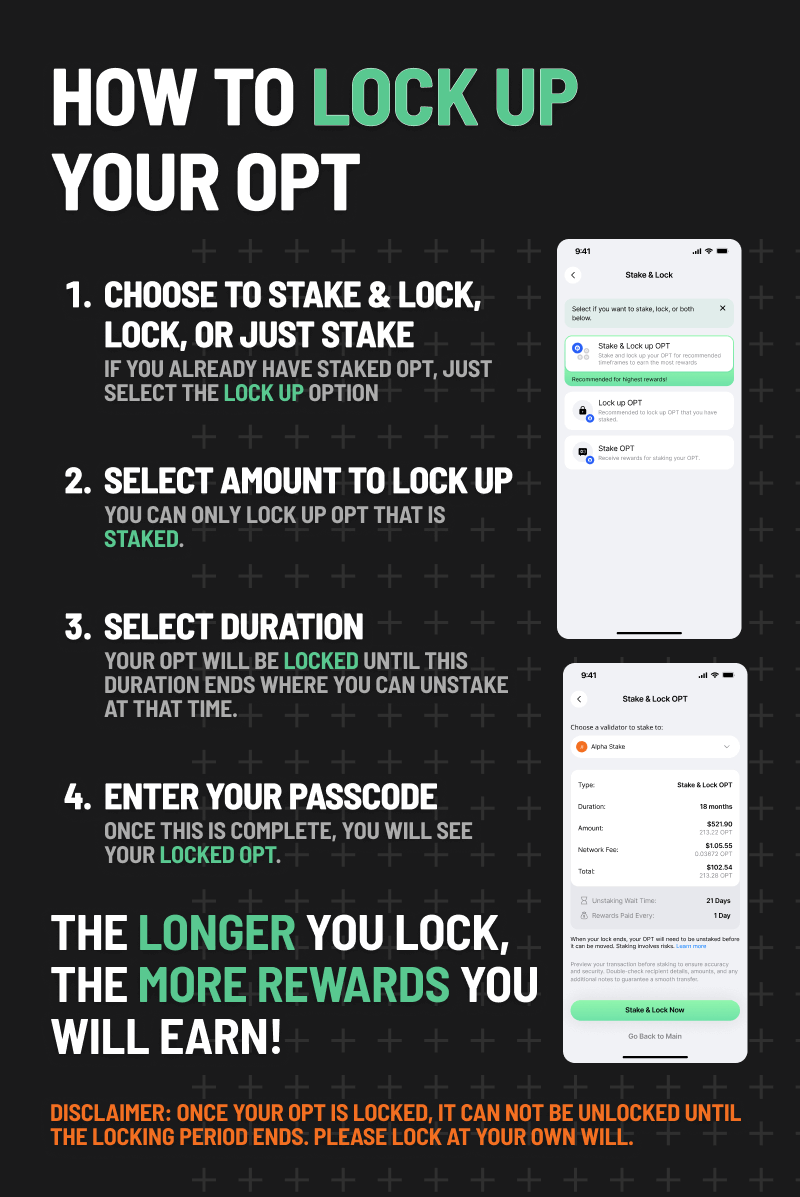

Long-Term Staking allows users to lock OPT that is already staked for a fixed duration between 6 and 24 months.

Key points to know:

Locked OPT continues participating in standard staking while also receiving additional time-weighted distribution participation.

There is no early unlock.

Long-Term Staking is available in the Staking and Locking hub inside Kyvo.

This unified experience allows users to stake, lock, extend locks, and view all positions in one place with clear rules shown before confirmation.

After confirmation, the lock transaction may take 1 to 2 minutes to appear in your Lock Up dashboard while the network processes the update.

Long-Term Staking increases a wallet’s time-weighted share of network distributions compared to standard staking alone.

Distribution weighting depends on:

Distributions for locked OPT are expected to begin on or after January 5. This date will be confirmed and announced once finalized.

Participation does not guarantee outcomes, and distribution amounts may vary based on overall network activity.

OPT is the digital asset used across the Optio network and is connected to activity across applications in the Parler ecosystem.

Users can earn OPT through participation across:

Kyvo brings these activities together by allowing users to manage OPT, stake it, and now lock it for long-term participation.

Long-Term Staking is intended for users who already participate and plan to continue doing so over time.

If you’re new to digital assets or crypto, you’re not alone.

Kyvo is designed to make participation simpler by giving you one place to manage your digital assets without giving up control. Kyvo is a non-custodial wallet, which means you hold your assets and private keys directly. No third party controls them on your behalf.

You can earn OPT through real activity across the Parler ecosystem, manage it in Kyvo, and choose whether or not to stake or lock it based on your comfort level and goals.

This Kyvo update also includes several platform enhancements:

This release introduces no breaking changes and is fully backward compatible.

Long-Term Staking establishes a foundation for future participation-driven features across the Parler ecosystem while maintaining transparency, user custody, and protocol-enforced rules.

Kyvo’s goal remains the same: make digital asset participation easier to understand, grounded in real applications, and accessible to users at every stage of experience. If you have questions about LTS (long-term staking), see our FAQs where you can also reach out to Support.